What you should Envision Financially Given that An initial-Time Homebuyer

Thus, you may be happy to get your first domestic. Congratulations! For most people, bringing this step is amongst the biggest monetary motions it makes within their whole lifestyle. Due to this and since its a whole lot more challenging than simply another thing you might need to money (such as for instance a vehicle), you are going to need to tread meticulously.

Certain latest surveys have shown many homeowners share be sorry for. Look of Zillow, for example, showed that 75% from homebuyers need to they had done one matter in different ways. From the one to-3rd regret to order a house that needs far more performs or restoration than just it in the first place expected. And another-quarter wanna they might have purchased for the yet another area.

But do not stress. Getting through the process unscathed can be done so long as you spend time and check away from the packages. Here you will find the essential one thing to own first-date people to remember whenever embarking on the browse. And also otherwise propose to buy something up until after in the year, teaching on your own now offers longer setting your self up for success.

Exactly how much Family Is it possible you Manage?

It’s important to know what you can afford to spend, and how far a specific price range will cost you the few days when it comes to a mortgage percentage. Lenders like to see that you’re spending only about 36% of the gross income on your financial or any other costs joint. They generally let you continue it proportion, however shouldn’t very attempt to for your own personel economic well being. You will have to factor in assessment fees, assessment charges and you will settlement costs – and that usually manage 3% in order to 6% of one’s price – and of course, your own advance payment. Even in the event one may put down only 3% and be eligible for a normal mortgage, think about seeking to lay out 10% preferably. And you will, if you’re able to get across the latest 20% down tolerance, you might end paying high priced private financial insurance policies, also known as PMI. Our home online calculator can help you which have understanding the will cost you out of a house.

Make sure you remember The other Will set you back away from Homeownership

Specific fiscal experts recommend creating what exactly is named to experience domestic, which means that finding out exactly what you will likely are obligated to pay monthly and you may then providing one to amount out of your finances every month, for example a beneficial mock mortgage repayment. After that, observe one to seems. Are you in a position to take control of your other expenses and you may each and every day spending? Are you going to be safe expenses one matter into 2nd 20 or thirty years? Finishing it exercise have a tendency to we hope leave you a baseline to have an effective home loan number you could conveniently afford. And don’t forget, the costs don’t end with your monthly home loan. Additionally, you will need package ahead to possess assets taxes, insurance coverage, utilities, garbage and you will trash costs, HOA fees, and you can repair charges. If you’ve got a friend in the region, inquire what they invest exterior its mortgage to obtain a concept regarding exactly what these can cost you are.

Work at Your credit rating

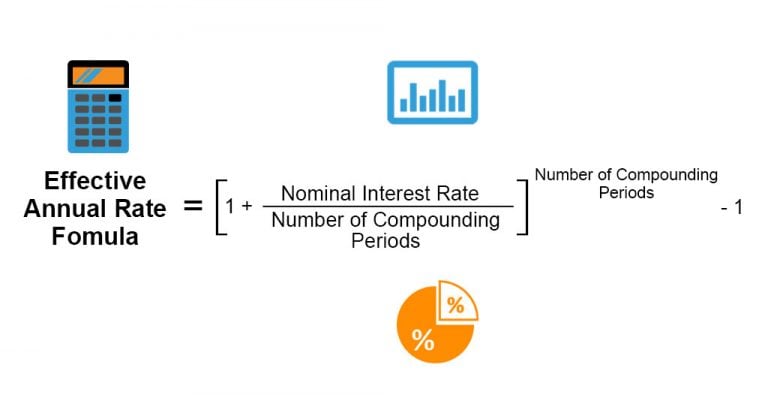

Home loan costs keeps jumped in recent years thanks to the batch of short-title interest hikes in the Federal Set aside. But a good deal of everything pay is in their control. The common home loan rate for someone having good borrowing from the bank score (from 760 so you can 850) is a complete 50 % of part below it had been for somebody which have a reasonable score (from 680 in order to 699). If you don’t have a credit history of over 660, FICO claims you may not look for mediocre rates of interest, however, tend to rather pay rates which might be greater.

Just what exactly should you do? On days before you could propose to make an application for that loan, look for where your credit rating was and you may try to increase they if you want to. That implies paying your own expenses on time, everytime, and paying off balances on your playing cards around it is possible to. Also, regarding meantime, you should never apply for credit you don’t need installment loans in Kingston to, but also hold off closure cards you aren’t using.

So if you’re finding some help making certain that your bank account and you may borrowing are located in good figure, read the Fund Fixx small fraction lessons program otherwise GreenPath to access one-on-you to definitely financial counseling.

Rating Pre-recognized Not only Pre-Accredited

First-time homeowners who get pre-accepted because of their mortgage renders a competitive provide easily whenever they look for its dream house. When you’re pre-acknowledged to own full funding, you possibly can make a confident provide and stay ahead of most other consumers just who will not to able to shut as easily. On the go pre-recognition, it’s adviseable to go home loan searching. As stated a lot more than, researching also provides and doing your research to find the best price eg having credit unions will save you money in the long run since lenders’ rates can differ dramatically.

However, note: You will should make sure you should have specific pillow when you look at the your bank account after you build your advance payment. This basically means, dont lose your own disaster financing and your trips loans into the order and make your brand-new domestic happen. Lenders want to see that you’re capable of making your own homeloan payment even though you eradicate your main source of money.

Ready, Set, (Window) Shop

You do not be prepared to purchase your very first family only yet, but it is a good idea to begin looking around to come across exacltly what the funds becomes your throughout the section you may be most interested during the. This should help you thin in the toward communities you love. During this time it’s also wise to emotionally prepare on the proven fact that there are numerous fish regarding ocean. Five away from 10 customers aren’t getting the initial household it create a deal into the, cards Amanda Pendleton, an excellent Zillow domestic fashion professional, whom warnings consumers to help you brace by themselves for many failures with each other the way in which.

Decide on your next residence’s must-haves and you can nice-to-haves. Exactly what do you reside instead of? Pendleton states roughly half all buyers need to make compromises to invest in property, therefore select now what men and women was. Is it possible you enjoys a longer commute, otherwise will you bring a smaller cooking area if you have a lovely learn bath? Determining where you’re willing to give up beforehand will help for the worry of having making a simple choice.

Usually do not Stop The home Assessment

Ultimately, if you are inclined to go without property assessment say someone happens to view the newest heavy out of a bidding battle here is a word of alerting: Usually do not. Its crucial to keeps an authorized and you will bonded professional provide it with an intensive just after-more than. Probably the best house actually really worth taking chances with the. And even this new residential property possess pricey-to-fix base products something would not be apparent to a first-date buyer crazy about the house.